By Sustainability, Digital Economy & Reporting Team

The Digital Technology Adoption Awards (DTAA), launched in March 2023 by the Malaysian Institute of Accountants (MIA), occupies a distinct niche in Malaysia’s awards landscape. The DTAA highlights exceptional achievements in technology adoption within the accountancy profession. It celebrates innovation across three key sectors of the profession: commerce and industry, public practice, and the public sector, recognising those at the forefront of digital transformation in accounting.

With support from the Ministry of Science, Technology, and Innovation (MOSTI), Bursa Malaysia, Malaysia Digital Economy Corporation (MDEC), MyDIGITAL and various other professional bodies and technology providers, the DTAA aims to promote technology adoption, raise awareness of the impact of digital adoption, and commend the digital technology adoption efforts of the accountancy profession – inspiring others undertaking their own digital transformation.

At the DTAA Presentation Dinner in May 2024 graced by the Deputy Minister of Finance YB Puan Lim Hui Ying, fourteen distinguished winners were honoured.

This exciting edition of DTAA Winners in Action explores the success story of PricewaterhouseCoopers Risk Services Sdn Bhd (PwC), the proud recipient of the ‘Top Excellence Award’ in the category of firms with over 300 employees. Acknowledged for their exemplary business continuity management practices enhanced by technology, Gayathri Jaganathan, PwC Malaysia Risk Services Director, shares the key factors behind PwC’s remarkable achievement in the DTAA.

What are your aspirations on digital technology adoption?

Based on PwC’s Global Crisis and Resilience Survey 2023 Malaysia report, 93% of organisations in Malaysia have experienced a disruption in the past two years. The recent pandemic signalled the need for strong Business Continuity Management (BCM) practices in every organisation. Resilience is recognised as one of the most important strategic organisational priorities for 55% of Malaysian organisations. However, only 9% rank technology enablement (i.e. leveraging resilience tools and software) as a top priority for future resilience.

BCM, a crucial process for managing operational disruptions resulting from a crisis, has traditionally been a highly manual process in most organisations. Business impact analysis and Business Continuity Plans (BCPs) are typically documented via Microsoft Excel or Microsoft Word, which can increase the risk of human errors and lengthen the time spent on documentation. The pandemic has certainly accelerated digital transformation and adoption, providing the impetus for PwC to transform our BCM services to offer asset-based solutions to our clients, ensuring that the business continuity plans are readily available and accessible at all times digitally.

What technologies have you adopted?

The Business Continuity Planner (the Planner) is a cloud-based tool developed in-house by PwC Malaysia to address the growing demand for a BCM platform to enable better BCM planning and maintenance. The central platform is developed based on globally recognised BCM Standards & Guidelines (i.e. ISO 22301:2019 Security and resilience – Business continuity management systems – Requirements). Developing a BCP using this platform ensures the organisation’s BCP is aligned to best practices and allows better synergy throughout the organisation. The real-time dashboard provides critical data to drive decision-making in the event of a crisis and allows organisations to bounce back faster.

How was your digital technology implementation journey?

We started with understanding the challenges that we face as BCM practitioners and brainstormed with our clients on some of these data points, with the aim of understanding the problems that

our clients face and working with them to solve these issues. We then brainstormed internally with our Digital Team to identify the ‘must have’ and ‘nice to have’ features which eventually led to the development of the Planner, after obtaining approvals from our internal stakeholders who were the project sponsors.

Before the solution went‘live’, we performed the User Acceptance Test (UAT) and security tests to ensure any errors were fixed and that the system remains secure. BCP was used both internally as well as with our clients, where any feedback was taken positively and rectified accordingly to ensure that the solution remains relevant and competitive in the market. The solution was also showcased to our other PwC network firms to encourage global adoption.

What is the impact of your technology adoption?

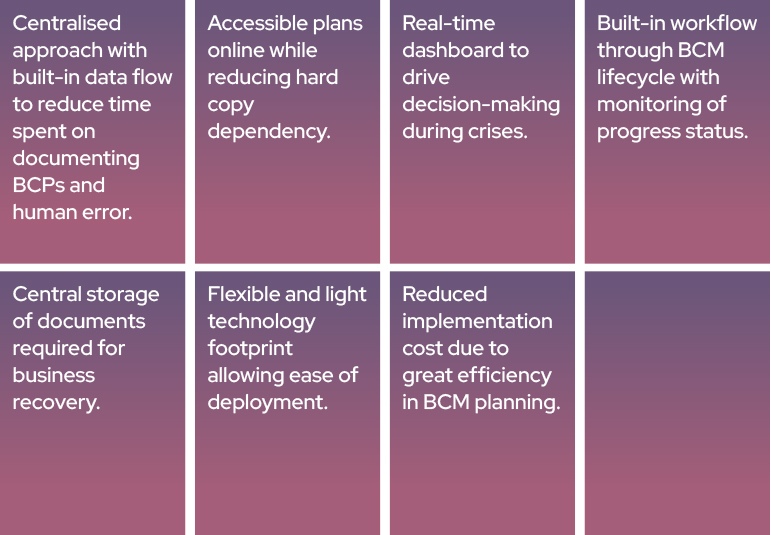

Our solution has addressed the need for effective BCM planning by delivering the following:

How are you planning to evolve digitally?

PwC is a firm believer in digital transformation. We recognise that as we continue to evolve as a business, we have to upskill our workforce, guided by a human-led and tech-powered approach to be able to effectively serve our clients.

We are currently investing in audit transformation, employing integrated automation and analytics to analyse transactions, identify anomalies and provide insights, among other areas designed to deliver a cloud-based audit experience. Among the key objectives are to reduce audit support time and minimise disruptions. The use of Artificial Intelligence (AI) in auditing is creating new opportunities for value creation, augmenting auditors with its ability to conduct research, summarise documents and allow greater focus on areas that require a higher level of critical thinking.

Do you have any tips to share with the readers?

The world is moving towards exploring Generative AI to improve employee efficiency and increase profitability. The need to evolve will continue to put pressure on organisations to keep up with new developments in the market and enhance their cyber resilience to safeguard data and information technology systems. It is time for organisations to consider taking small steps in identifying some of the processes that can be digitalised and start from there. This can be in the form of digitising records and integrating digital tools in existing business processes to explore more efficient ways of working.

Why did you participate in the DTAA?

We continue to encourage our colleagues to be open to digital adoption and showcase the value of their work through sharing of use cases and participation in awards like this as a yardstick for their performance against industry peers. By participating in the DTAA, I was able to share my problem statement, challenges and how we worked internally to overcome them. This experience would be very relatable to the Risk and BCM practitioners in the market.

What is your advice to aspiring participants of the DTAA in the future?

My advice to aspiring participants in the future is to share and articulate your success story confidently and use the DTAA as a platform to validate your achievements through meaningful success metrics and industry benchmarks.

For more information about the DTAA and the complete list of winners, click the links below: