By Gagandeep Nagpal and Himanshu Bakshi

Introduction

With the increasing complexity of global tax developments, taxpayers are facing greater challenges in managing their tax matters. To help alleviate this burden, safe harbours have emerged as an important solution as witnessed in Pillar 1/Pillar 2 regimes recently. They provide simplified, predefined resolutions for common tax matters, offering certainty and consistency in outcomes when specific conditions or fact patterns are met.

Amidst these global developments, Malaysia’s Inland Revenue Board (IRB) has introduced safe harbours for low value-adding services (LVAS) as part of the revised Malaysia Transfer Pricing Guidelines (MTPG 2024). This move aligns Malaysia’s transfer pricing framework with that of the Organisation for Economic Co-operation and Development (OECD)Transfer Pricing Guidelines 2022, albeit there are some deviations that require careful consideration by taxpayers. . This development is welcomed and expected to ease the burden on Malaysian taxpayers in defending their intra-group service transactions. Notably, Malaysia is the second country in the Southeast Asia region, after Singapore, to recognise the LVAS framework.

It is crucial to understand the key features, eligibility criteria, and other nuances before opting into this framework.

What is LVAS?

In large multinational enterprise (MNE) groups, common functions are usually centralised to streamline operations, enhance efficiency, and avoid duplication of efforts. Intra-group services are generally remunerated using the cost-plus method, where appropriate allocation keys are applied to distribute the service provider’s charges across all service recipients within the group. However, this area often becomes contentious in transfer pricing, particularly concerning the need test, benefit test, rendition test and arm’s length price test. The simplified approach of LVAS can help resolve potential disputes that may arise during audits regarding the transfer pricing of intra-group transactions.

- LVAS are services that one or more MNE group members provide on behalf of one or more other group members, which¹:

- are of a supportive nature

- are not part of the core business of the MNE group (i.e., not creating profit-earning activities or contributing to economically significant activities of the MNE group);

- do not require the use of unique and valuable intangibles and do not lead to the creation of unique and valuable intangibles; and

- do not involve the assumption or control of substantial or significant risk by the service provider and do not give rise to the creation of significant risk for the service provider.

The term “supportive” herein implies that the service should not be part of the core business of the MNE group. However, the provision of low value-adding intra-group services can still be the principal business activity of the entity providing the service, as long as these services are not related to the core business of the group.²

The fact that an activity does not fit into the above criteria, should not be interpreted to mean that the activity should generate high returns, which specifically has been mentioned in OECD but seems to be intentionally missing in MTPG. It may still be a low-value activity, and the arm’s length charge for such an activity should be determined through a standard benchmarking analysis.³

The new guidance also provides a negative list of services that would not qualify for the simplified approach⁴. In addition, a few examples are also provided that would likely meet the definition of LVAS⁵. It will be crucial for taxpayers to evaluate if their services meet the requirements outlined in the LVAS framework; otherwise, there may be disagreements during the audit stage. Since it is an elective regime⁶ and, as there is no threshold set for its applicability, it would be prudent for taxpayers to carefully assess the impact of the LVAS framework and adopt it consistently once chosen.

What are the benefits of opting for LVAS framework?

Simplification of arm’s length price test

As recommended by the OECD and adopted by MTPG 2024⁷, the safe harbour markup of 5% shall be applied to all relevant costs (direct or indirect cost but excluding pass-through cost⁸) incurred in performance of services. This approach simplifies the transfer pricing calculation process as it avoids the need for complex benchmarking studies or economic analyses. It further provides certainty for MNE groups that the price charged for qualifying activities will be accepted by the IRB. Moreover, this simplified framework also permits application of similar mark-ups for all LVAS, irrespective of categories of services⁹.

However, the above simplified approach cannot be adopted if services are rendered to unrelated customers because it can be expected that reliable internal comparables exist and can be used for the determination of arm’s length price.

Simplification in establishing benefit test

In the context of intra-group services, one of the most highly disputed areas is establishing the benefit test before tax authorities which can be even more challenging than demonstrating compliance with the arm’s length principle. Taxpayers opting for the LVAS regime are expected to maintain additional documentation as outlined in Appendix A of MTPG 2024 as part of their contemporaneous transfer pricing documentation (CTPD). However, this documentation requirement appears to be less burdensome than that for those not opting for the LVAS framework¹⁰. Further, there is an additional guidance in OECD regarding benefit test which appears to be missing in MTPG 2024 and may leave room for some ambiguity in the interpretation by taxpayers and the application by tax administration¹¹.

LVAS is not panacea

While the LVAS framework helps mitigate disputes arising from the subjectivity involved in intra-group charges, it could also lead to new areas of contention during the course of audits. Some key potential issues are highlighted below.

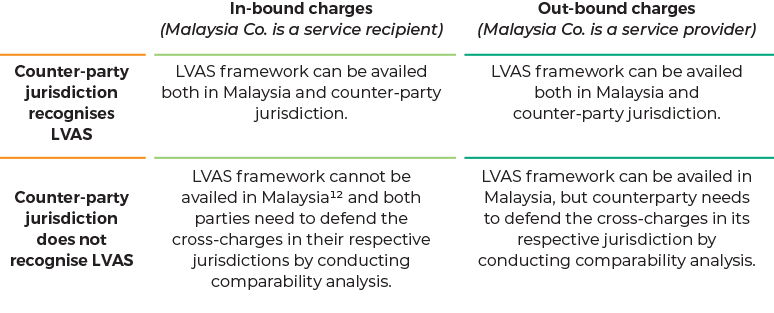

Differing views of tax authorities in situations where jurisdictions of the transacting entities have different views on the recognition of LVAS framework, the following scenarios could arise:

If the counterparty’s jurisdiction does not recognise the LVAS framework, an arm’s length analysis could yield different outcomes, and the possibility of double taxation cannot be ruled out. This issue is further complicated by differences in the recognised arm’s length range where Malaysia adheres to a narrower range of 37.5% to 62.5%, while the counterparty may recognise an inter-quartile range.

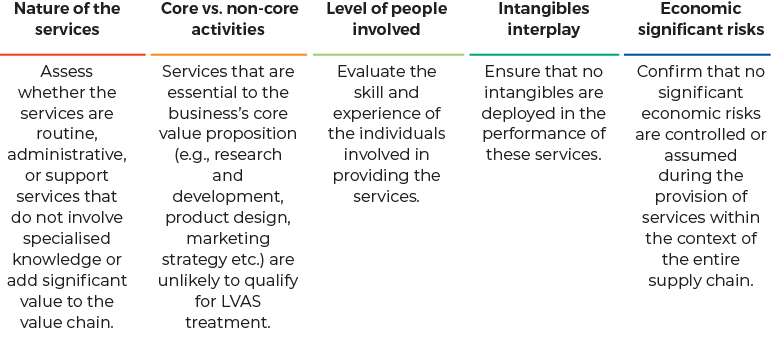

Meeting eligibility criteria could be another possible dispute area. Despite the existence of clearly defined criteria, a negative list, and illustrative examples, there can still be subjectivity in evaluating eligibility. The following key indicators would help taxpayers in determining their eligibility:

A mixed bag of services could also lead to disputes, such as when core services are performed alongside low value-added services. In such cases, the taxpayer could either adopt a segmentation approach (splitting core and support services) or choose to move away from the LVAS framework altogether and defend the arrangement under the normal comparability analysis regime.

We will need to wait a few more years to observe other potential dispute areas that may arise from the LVAS framework once the IRB begins auditing the years covered by the framework (i.e., from the year of assessment 2023 onwards).

Conclusion

The LVAS framework is expected to provide much needed certainty and reduce significant transfer pricing disputes related to intra-group service arrangements. However, taxpayers should take following preparatory steps before opting LVAS safe harbour:

- A well-executed intercompany agreement defining the nature of services, basis, roles, and responsibilities of the transacting parties will provide a strong starting point for accurately delineating the transaction and assessing eligibility.

- An assessment of eligibility criteria through functional interviews with individuals involved in providing and receiving services is necessary.

- Effective operationalisation of the transfer pricing policy to achieve the targeted 5% return by the end of the year is essential.

- Continuous monitoring, as new services may be added over time, or changes in risk profiles or accounting practices may affect the cost structure.

- Preparation of contemporaneous transfer pricing documentation in compliance with MTPG 2024, along with supporting cost calculations as outlined in Appendix A of MTPG 2024.

The above approach is expected to provide the desired benefits that taxpayers seek from the LVAS framework. Taxpayers should monitor how the IRB regulates this regime during audits and refine its approach over time.

¹ Para 6.24 of MTPG 2024

² Para 6.22 of MTPG 2024

³ Para 7.48 of OECD Transfer Pricing Guidelines 2022

⁴ Para 6.25 of MTPG 2024

⁵ Para 6.26 of MTPG 2024

⁶ Para 6.19 of MTPG 2024

⁷ Para 6.27(c ) of MTPG 2024

⁸ Para 6.27(a) of MTPG 2024

⁹ Para 6.27(b) of MTPG 2024

¹⁰ Para 11.7 of MTPG 2024

¹¹ Para 7.54 and Para 7.55 of OECD Transfer Pricing Guidelines 2022

¹² Para 6.21 of MTPG 2024

Gagandeep Nagpal is Transfer Pricing Partner, Deloitte Malaysia.

Himanshu Bakshi is Transfer Pricing Director, Deloitte Malaysia.

The content in this article are personal views of the authors and does not purport to reflect the views of Deloitte Malaysia.