The volatile business landscape and growing challenges to business resilience mean that the risk of insolvency and bankruptcy is omnipresent.

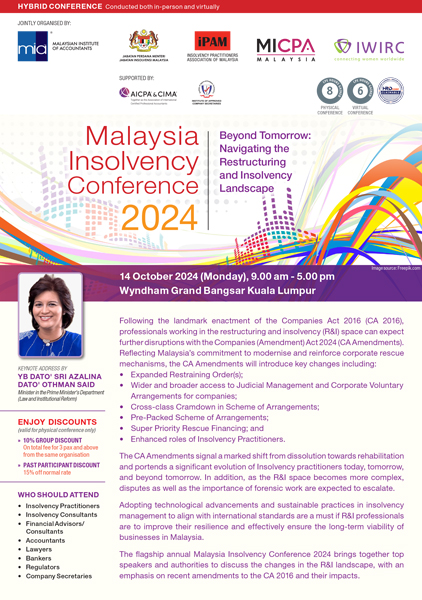

To mitigate this risk and support business continuity and economic well-being, the Malaysian Institute of Accountants (MIA) along with Jabatan Insolvensi Malaysia, Insolvency Practitioners Association of Malaysia (iPAM), The Malaysian Institute of Certified Public Accountants (MICPA) and The International Women’s Insolvency and Restructuring Confederation (IWIRC) prioritises the development of insolvency best practices and future-proofing of insolvency practitioners.

The Malaysia Insolvency Conference 2024 looks to empower practitioners and members towards ensuring their future relevance Beyond Tomorrow: Navigating the Restructuring and Insolvency Landscape. The Conference focuses on the latest events in the insolvency space and highlights changing and impactful regulations, with guest of honour and legal expert YB Dato’ Sri Azalina Dato’ Othman Said, Minister in the Prime Minister’s Department setting the tone with her keynote address. From the regulatory perspective, there will also be a presentation by the Malaysian Department of Insolvency on the Enhanced Role of Liquidators: The Way Forward.

Importantly, conference delegates will be familiarised with the Companies (Amendment) Act 2024 (CA Amendments), which reflects Malaysia’s commitment to modernise and reinforce corporate rescue mechanisms towards fortifying business resilience.

The Conference will focus on the key changes brought about by the CA Amendments, including:

- Expanded Restraining Order(s);

- Wider and broader access to Judicial Management and Corporate Voluntary Arrangements for companies;

- Cross-class Cramdown in Scheme of Arrangements;

- Pre-Packed Scheme of Arrangements;

- Super Priority Rescue Financing; and

- Enhanced roles of Insolvency Practitioners.

The CA Amendments signal a marked shift from dissolution towards rehabilitation, necessitating that insolvency practitioners reinvent themselves to embrace this transformed and more sustainable approach. Practitioners must also prepare themselves for expected escalations in dispute and increased reliance on forensic work as the R&I space becomes more complex post CA Amendments.

A key strategy for practitioners will be to adopt technological advancements and align seamlessly with international standards to heighten their competencies and effectively ensure the long-term viability of businesses in Malaysia.

Leading speakers and authorities will be on hand at the Malaysia Insolvency Conference 2024 to guide practitioners and members on navigating the evolving R&I landscape via the following carefully curated sessions:

Navigating the New Waves: Key Changes and Implication of the Companies (Amendment) Act 2024

The Companies (Amendment) Act 2024 (Amendment Act) which came into force on 1 April 2024 enhances inter alia the existing provisions on schemes of arrangement and corporate rescue mechanisms in the Companies Act 2016 and introduces the new beneficial ownership reporting framework for companies. This discussion explores the myriad changes brought about within the judicial framework in Malaysia following the implementation of the Amendment Act, in particular, what insolvency practitioners in public practice can expect moving forward.

Navigating Cross-border Insolvency: Key Insights on the Uncitral Model Law

Malaysia is currently considering the adoption of the UNCITRAL Model Law on Cross-Border Insolvency (1997) (MLCBI or Model Law) which is designed to assist member States to equip their insolvency laws with a modern, harmonised and fair insolvency framework. Model Law adoptees would be able to more effectively address cross-border insolvency proceedings concerning debtors experiencing severe financial distress or insolvency. This session focuses on the key objectives and achievements of the Model Law, the adoption and implementation of other instruments and cooperation protocols which extend across borders, and the potential opportunities emerging from the prospective Model Law adoption.

Unveiling Hidden Fortune and Wealth: Strategies for Tracing and Recovering Digital and Specialised Assets

Recent years have seen a spate of high-profile insolvencies in the cryptocurrency industry (i.e. Three Arrows Capital, FTX, Babel etc.) as well as the rising use of digital assets as a mechanism to facilitate cross border fraud. This session focuses on critical practical issues for insolvency practitioners in identifying and securing control of these digital assets (i.e. accessing private keys and locating cold wallets), while amplifying the risk of a deliberate misappropriation of assets. The expert speakers will also recommend mitigation strategies and share key takeaways from various recent cases involving digital assets by neighbouring jurisdictions.

Expert Insights Into Global Macro Insolvency Trends and Potential Reforms in the Insolvency Regime

In the concluding discussion, practitioners will be briefed on global macro insolvency trends and potential regime reforms that could address emerging challenges in the insolvency landscape and chart the way forward.

To sign up for the Malaysia Insolvency Conference 2024, please visit here.