By SMP Department, Professional Practices & Technical Division

MIA’s stance on audit exemption goes as far back as 2013 when Suruhanjaya Syarikat Malaysia (SSM) issued the consultative document on the Companies Bill for public consultation. MIA had then proposed to SSM that only dormant companies be exempted from statutory audit in consideration of various factors, including the value generated by audit for private entities, the ripple effects on regulatory bodies like SSM, the Inland Revenue Board, and the Royal Malaysian Customs, and ultimately, the broader impact on the Malaysian economy. Additionally, MIA’s stance aimed to provide a supportive environment for smaller audit firms, ensuring a smoother transition amidst regulatory changes. This stance was reiterated in a response to a Draft Practice Directive in 2016. Subsequently, when SSM issued Practice Directive (PD) 3/2017 for implementation of audit exemption in Malaysia, the thresholds were much lower (i.e. revenue threshold at RM100,000, assets’ threshold at RM300,000 and employees’ threshold at 5 persons) if compared to the original proposal. This decision was influenced by feedback from various stakeholders, including MIA.

Public Consultation in February 2023

Fast forward to February 2023, 6 years after the issuance of PD3/2017, SSM issued the Consultative Document on the Proposed Review of Audit Exemption Criteria for Private Companies in Malaysia (CD). This document sought the public’s view on the proposed revisions to the audit exemption criteria, which mainly suggested an increase in the revenue threshold (from RM100,000) and assets’ threshold (from RM300,000) to RM1 million and employee threshold (from 5 persons) to 30 for threshold-qualified companies.

MIA shared our perspectives to SSM and highlighted that although MIA broadly agreed with the proposed review in audit exemption thresholds, a strong consensus on audit exemption thresholds for smaller companies might be unattainable because of the existence of different perspectives from the varied stakeholders of MIA and there was a lack of available comprehensive impact assessment done by SSM pertaining to the current proposals, including the analysis of the expected costs, the benefits and the impact of the policy and that the benefits outweigh the costs.

In the event that the proposed increases in the thresholds are implemented, MIA recommended the following safeguards to ensure that the changes are well-executed:

- Baseline requirements for finance function to include a member of MIA;

- Introducing alternatives to audits, such as review and compilation services;

- Strengthening statutory declaration under Section 251(1)(b) of the Companies Act 2016 to be performed by a member of MIA.

Public Consultation in February 2024

In February 2024, SSM issued the Consultative Document on the Proposal of the New Audit Exemption Criteria for Private Companies in Malaysia (CD) that introduces significant changes to the audit exemption criteria for private companies in Malaysia, for public consultation.

The following are key highlights of the revised audit exemption criteria which aim to extend the potential benefits of reduced regulatory burdens and lowered cost of doing business to a larger number of small companies:

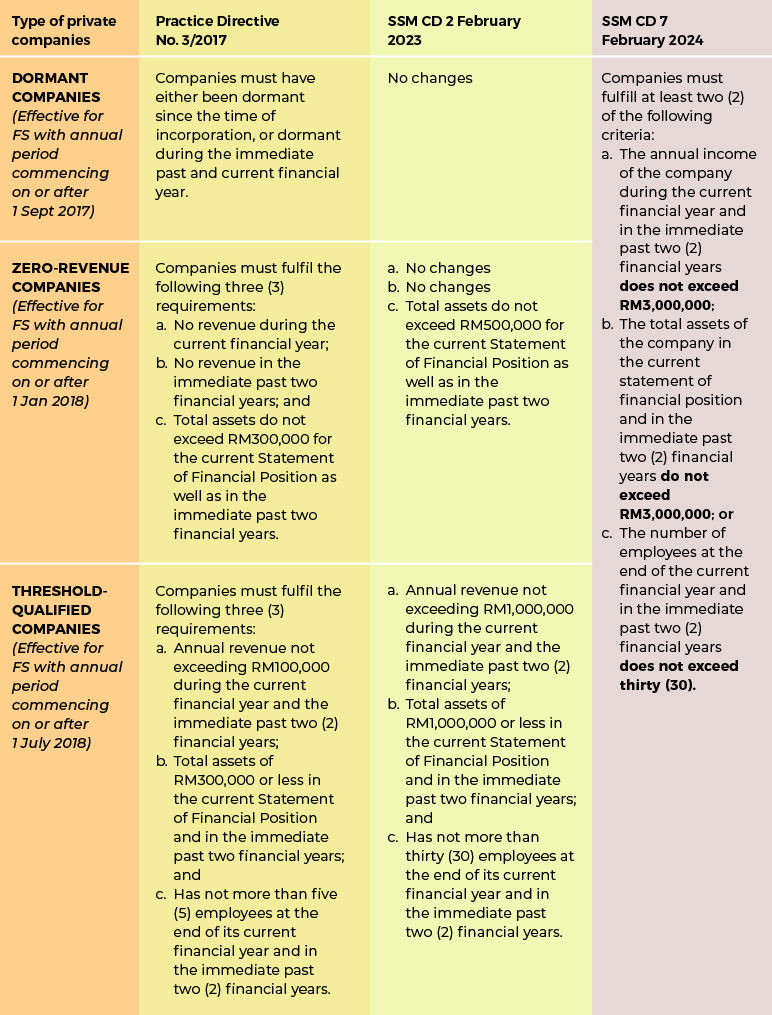

The proposed revisions compared to the current criteria as per Practice Directive 3/2017 are as per the table below.

Practice Directive No. 3/2017 (click here to download)

SSM CD 2 February 2023 (click here to download)

SSM CD 7 February 2024 (click here to download)

The rationale for revision of threshold

In SSM Consultative Documents issued in February 2023 and February 2024, it was stated that the threshold was reviewed to ensure it is relevant to achieve the objective of audit exemption and thus, ensuring the maximum number of companies could benefit from the audit exemption. In addition, it also aimed to help SMPs transform the current landscape to one that is progressive and able to move up the value chain of professional services to better serve the needs of SMEs; easing the burden due to the current shortage of auditors (including their staff) in Malaysia.

The quantum of the revision of threshold

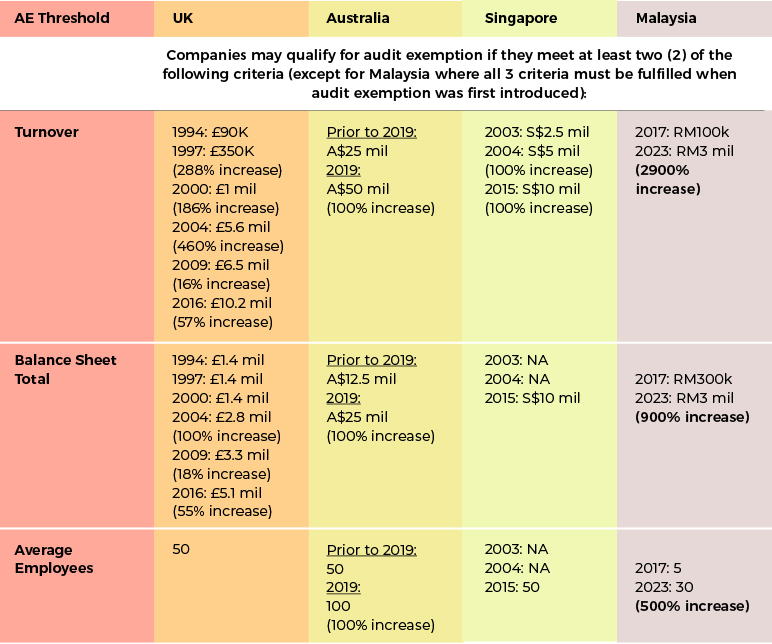

While the increase in thresholds aligns with the practices adopted in various other developed nations such as Singapore, the United Kingdom and Australia, it is important to note that the increases in the Malaysian context are very substantial as demonstrated in the table below:

It is imperative to bear in mind that the appropriateness of audit exemption must be carefully evaluated within the Malaysian context, which varies significantly in terms of economic scale, business landscape, and the level of maturity of accounting and financial reporting practices among small companies. While the increase in thresholds appear to move in the direction of practices adopted in various other developed nations such as Singapore, the United Kingdom and Australia, it is important to note that these countries are highly developed economies with a much larger economy and a much bigger base and depth of businesses compared to Malaysia. The small businesses in these countries are generally larger in size compared to those in Malaysia.

These leading jurisdictions have developed their audit exemption regimes over a significantly longer period of time thus reducing the “sudden displacement” to the marketplace and users of audited financial statements.

While there may be perceived benefits from audit exemption such as reduced cost of doing business, savings in management time and resources that can be reallocated for other purposes, there are also other perceived costs and social impacts that could potentially outweigh these advantages. The perceived costs include poorer accounting quality leading to misleading financial statements, potential tax implications due to risks of underreporting, increased economic crime facilitated by a laxer regulatory regime, and the loss of a training ground for future accountants as fewer audit firms operate in Malaysia, limiting opportunities for professional development. Therefore, any policy revision regarding audit exemption should only be considered if the perceived benefits clearly outweigh the associated costs.

Why gradual increase of threshold should be the way forward

While some owner-managed companies with good governance and financial management may benefit from audit exemption, it may not be universally applicable to all such entities. For business owners who are not financially trained, audits necessitate the need for proper accounts preparation as well as contributing to internal control enhancement, fraud deterrence, operational efficiency and cost-effectiveness, and improved access to funding. Overall, audits offer business owners peace of mind, credibility, and valuable insights into the financial health and operations of their companies, ultimately supporting long-term success and growth. A gradual approach will benefit SMEs in their decision to opt for audit exemption as they need to assess their business growth trajectory, balancing the potential benefits of exemption against the risk of incurring substantial audit costs to perform work on opening balances, if they no longer qualify for exemption.

In 2017, the Swedish National Audit Office conducted a study on the impact of audit exemption for small, limited companies which was implemented in Sweden on 1 November 2010. The study aimed to assess whether the intended outcomes of the reform were realised, examine the consequences of the exemption and evaluate how any undesirable effects were addressed. The report’s impact assessment revealed that audits of small entities contribute value to both the companies and the public good. Exempting companies from audits was found to increase risks to the economy, including risks of accounting errors, tax evasion, and economic crime. Consequently, the study recommended the reintroduction of audit obligation for small limited companies. Based on the findings, the Swedish Government decided to keep the thresholds as they were, i.e. not to exempt more companies from the audit requirement. Lessons from the experience in Sweden underscore the potential risks associated with audit exemptions, emphasising the need for a gradual and balanced approach.

The strategic decision by SSM to establish a low threshold during the introduction of audit exemption in 2017 facilitated a smooth industry transition. Acknowledging this precedent, should there be an increase in thresholds, MIA advocates for a deliberate and phased strategy, incorporating an exhaustive policy impact assessment complemented by a transparent timeline and detailed roadmap to ascertain effectiveness and align with SSM’s objectives of alleviating regulatory burdens and cost for small enterprises while addressing the audit profession’s talent shortage. This approach allows for comprehensive deliberation and preparation, ensuring a smooth adaptation to any forthcoming revisions in thresholds.

This is the first of a two-part article on audit exemption thresholds in Malaysia.