By Sustainability, Digital Economy, and Reporting (SDER)

This article provides updates on the developments in the global standard setting agenda by the International Public Sector Accounting Standards Board (IPSASB) in 2023. It focuses on the latest pronouncements on measurement, revenue and transfer expenses, retirement benefit plans and IPSASB Conceptual Framework for General Purpose Financial Reporting by Public Sector Entities.

Measurement

IPSASB has issued an integrated package of measurement-related pronouncement comprising updates in Chapter 7, Measurement of Assets and Liabilities in Financial Statements from IPSASB Conceptual Framework, issuance of IPSAS 45, Property, Plant and Equipment and IPSAS 46, Measurement.

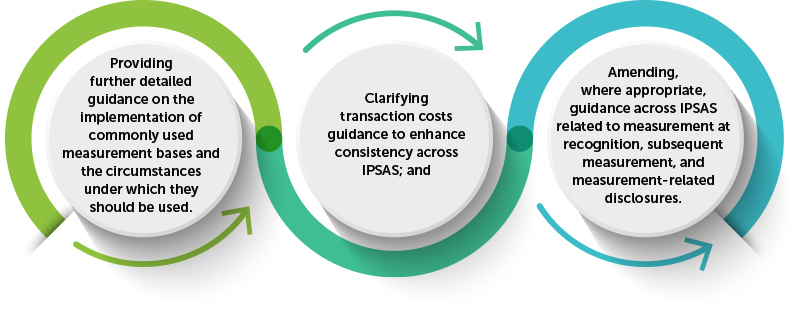

The objectives of IPSASB’s measurement project were to improve measurement guidance across IPSAS by:¹

Updated Conceptual Framework: Chapter 7, Measurement of Assets and Liabilities in Financial Statements

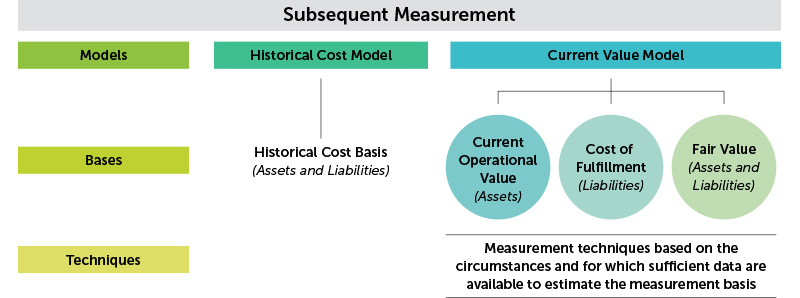

The chapter streamlines the measurement principles by eliminating unused measurement bases and enhancing focus on those that are commonly used. The new subsequent measurement framework will help constituents apply the principles in practice and aligns measurement concepts with the guidance provided in IPSAS 46, Measurement.²

IPSAS 45, Property, Plant and Equipment

Published in May 2023, IPSAS 45 replaces IPSAS 17, Property, Plant and Equipment and adds current operational value as a measurement basis in the updated current value model for assets within its scope, identifies the characteristics of heritage and infrastructure assets, and incorporates new guidance on how these important types of public sector assets could be recognised and measured.

Paragraph AG3 of IPSAS 45 outlines distinguishing characteristics of a heritage asset in the following manner:

- They have restrictions on their use and/or disposal.

- They are irreplaceable; and

- They have long and sometimes indefinite useful lives.

While paragraph AG5 of IPSAS 45 listed out the following characteristics of infrastructure assets:

- They are networks or systems; and

- They have long useful lives.

IPSAS 46, Measurement

IPSAS 46 provides new guidance in a single standard addressing the measurement bases that assist in reflecting fairly the cost of services, operational capacity and financial capacity of assets and liabilities. It brings in generic guidance on fair value for the first time, and introduces current operational value, a public sector specific current value measurement basis addressing constituents’ views that an alternative current value measurement basis to fair value is needed for certain public sector assets.²

Paragraph 7 of IPSAS 46 requires an item to be initially measured at its transaction price, plus or minus transaction costs for assets and liabilities respectively. In accordance with paragraph 6 of IPSAS 46, transaction price is defined as the consideration given to acquire, construct or develop an asset or received to assume a liability.

Subsequently, after initial measurement, paragraph 17 of IPSAS 46 requires an entity to make an accounting policy choice to measure an asset or liability whether on a historical cost basis or a current value basis. The accounting policy choice is reflected through the selection of the measurement bases.

Revenue and Transfer Expenses

IPSASB has issued a comprehensive bundle of revenue and transfer expenses pronouncements comprising updates in Chapter 5, Elements in Financial Statements from IPSASB Conceptual Framework and the issuance of IPSAS 47, Revenue and IPSAS 48, Transfer Expenses.

Updated Conceptual Framework: Chapter 5, Elements in Financial Statements

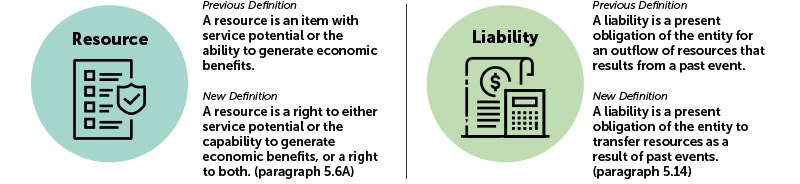

The chapter revises the definitions of an asset and a liability and adds a new guidance on the transfer of resources, unit of account and binding arrangements that are equally unperformed.³ These changes provide a strong foundation for the guidance in IPSAS 47 and IPSAS 48 especially on the incorporation of rights and transfer resources elements in the definitions of an asset and a liability.

Paragraph 5.6 of the Conceptual Framework defined an asset as a resource presently controlled by the entity as a result of a past event. IPSASB has revised the definition of the term resource and liability as follows:

IPSAS 47, Revenue

IPSAS 47 replaces the three revenue standards – IPSAS 9, Revenue from Exchange Transactions, IPSAS 11, Construction Contracts and IPSAS 43, Revenue from Non-Exchange Transactions (Taxes and Transfers). The new IPSAS is aligned with IFRS 15, Revenue from Contracts with Customers while broadening its applicability across the public sector. Additional guidance is included to help entities apply the accounting principles to public sector-specific transactions, such as capital transfers⁴ and compelled transactions⁵.³

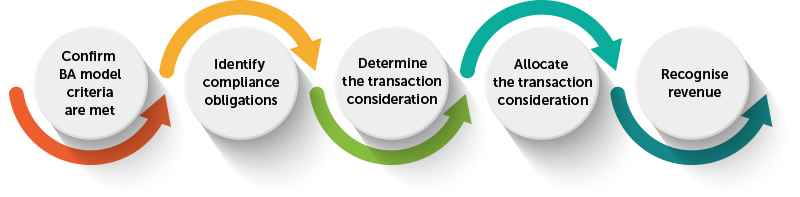

IPSAS 47 outlines two accounting models for the recognition and measurement of public sector revenue transactions based on the existence of a binding arrangement. Paragraph 4 of IPSAS 47 defines a binding arrangement as an arrangement that confers both rights and obligations, enforceable through legal or equivalent means on the parties to the arrangement.

Recognition of Revenue Transactions without a Binding Arrangement

Paragraph 29 of IPSAS 47 requires an entity to recognise revenue from a transaction without a binding arrangement when the entity satisfies any obligations associated with the inflow of resources that meet the definition of a liability or immediately if the entity does not have an enforceable obligation associated with the inflow of resources.

Recognition of Revenue Transactions with a Binding Arrangement

While aligned in principles, the accounting model for revenue with binding arrangements in IPSAS 47 broadens the approach in IFRS 15 to address public sector transactions. Two key aspects adapted for the public sector are binding arrangements and compliance obligations. Paragraph 87 of IPSAS 47 states that “when an entity receives an inflow of resources in a revenue transaction with a binding arrangement that meets the definition of and recognition criteria for an asset in accordance with paragraphs 18-25, the entity shall recognise revenue for any satisfied compliance obligations in respect of the same inflow and a liability for any unsatisfied compliance obligations in respect of the same inflow”.

An entity shall account for a binding arrangement using the binding arrangement accounting model if all the recognition criteria in paragraph 56 from IPSAS 47 are met.

When a compliance obligation is satisfied, paragraph 108 of IPSAS 47 requires an entity to recognise as revenue the amount of the transaction consideration that is allocated to that compliance obligation. Paragraph 109 of IPSAS 47 defines transaction consideration as the amount of resources to which an entity expects to be entitled in the binding arrangement for satisfying its compliance obligations, excluding amounts collected on behalf of third parties.

IPSAS 48, Transfer Expenses

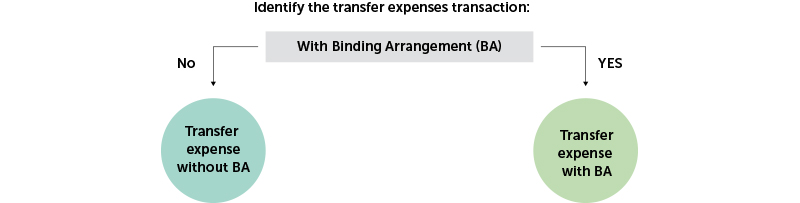

IPSAS 48 introduces guidance for transfer expenses, where a transfer provider provides resources to another entity without receiving anything directly in return, which is common in the public sector. The accounting for transfer expenses is driven by whether the transaction results in an enforceable right to have the transfer recipients satisfy their obligations.³ Paragraph 6 of IPSAS 48 defines a transfer expense as an expense arising from a transaction, other than taxes, in which an entity provides a good, service, or other asset to another entity (which may be an individual) without directly receiving any good, service, or other asset in return.

IPSAS 48 presents two accounting models based on the existence of a binding arrangement which are as follows:

Transfer Expenses from Transactions without Binding Arrangements

When a transfer expense arises from a transaction without a binding arrangement, paragraph 18 of IPSAS 48 requires an entity to first consider whether it has a constructive or legal obligation related to the transfer. If so, the entity recognises an expense and a provision under IPSAS 19, Provisions, Contingent Liabilities, and Contingent Assets. The subsequent transfer of resource to the transfer recipient settles the provision and if there is no related constructive or legal obligation, the entity derecognises the assets to be transferred and recognises a transfer expense when it ceases to control these resources.

Transfer Expenses from Transactions with Binding Arrangements

Meanwhile, for transfer expense transaction with binding arrangements, paragraph 24 of IPSAS 48 requires an entity to recognise expenses when a transfer right asset⁶ is derecognised or when a transfer obligation liability is recognised.

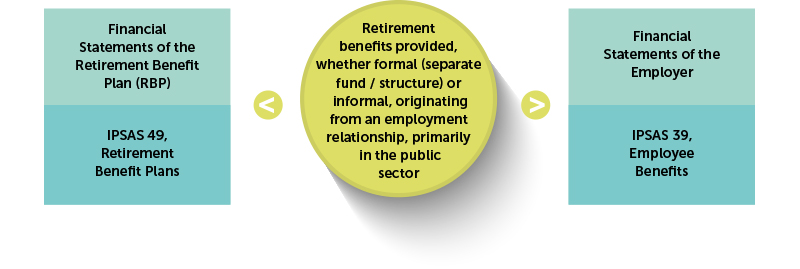

Retirement Benefit Plans

IPSAS 49, Retirement Benefit Plans

IPSAS 49 establishes comprehensive accounting and reporting requirements for the financial statements of retirement benefit plans, with participants comprising current and former public sector employees and other eligible members. IPSAS 49 guides the accounting and reporting by a retirement benefit plan from the perspective of the plan itself.⁷

Conceptual Framework for General Purpose Financial Reporting by Public Sector Entities

Updated Conceptual Framework: Chapter 3, Qualitative Characteristics

The updated chapter includes guidance on prudence, which is not a separate qualitative characteristic in its own right and adds ‘obscuring’ information to ‘misstating’ and ‘omitting’ information as a factor relevant to materiality judgments.⁸

Role of Prudence

The updated chapter includes guidance on the role of prudence in supporting neutrality in the context of qualitative characteristic of faithful representation. Prudence is the exercise of caution when making judgments under conditions of uncertainty. The exercise of prudence means that assets and revenue are not overstated, and liabilities and expenses are not understated.

Obscuring Information

Paragraph 3.32 of the Conceptual Framework states that information is material if omitting, misstating, or obscuring it could reasonably be expected to influence the discharge of accountability by the entity, or the decisions that users make on the basis of the entity’s General Purpose Financial Reports (GPFRs) prepared for that reporting period. Materiality depends on both the nature and amount of the item judged in the particular circumstances of each entity.

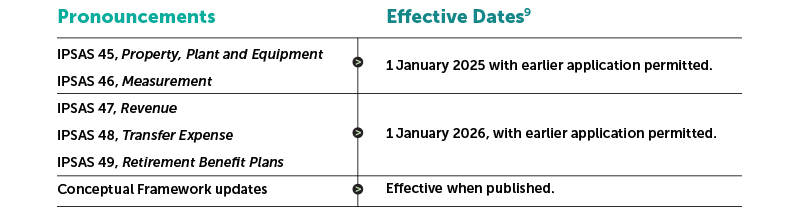

Effective dates

The effective date of the issued pronouncements are as follows:

¹ “At a Glance IPSAS 46, Measurement and Update of Chapter 7 of the Conceptual Framework”; May 2023; https://ifacweb.blob.core.windows.net/publicfiles/2023-05/IPSAS-46-Ch7-AAG.pdf

² “IPSASB Issues Package of Measurement-Related Pronouncements”, 29 May 2023; https://www.ipsasb.org/news-events/2023-05/ipsasb-issues-package-measurement-related-pronouncements

³ “IPSASB Issues Package of Revenue and Transfer Expense-Related Pronouncements”, 31 May 2023; https://www.ipsasb.org/news-events/2023-05/ipsasb-issues-package-revenue-and-transfer-expense-related-

pronouncements

⁴ Paragraph 4 of IPSAS 47 defines a capital transfer as an inflow of cash or another asset that arises from a binding arrangement with a specification that the entity acquires or constructs a non-financial asset that will be controlled by the entity.

⁵ Refer to paragraph 171 of IPSAS 47 for further guidance on compelled transactions.

⁶ Paragraph 6 of IPSAS 48 defines a transfer right asset as the asset recognised for the existence of one or more transfer rights arising from a binding arrangement and transfer obligation liability as the liability recognised for the existence of one or more transfer obligations arising from a binding arrangement.

⁷ “IPSASB Issues IPSAS 49, Retirement Benefit Plans”, 7 November 2023; https://www.ipsasb.org/news-events/2023-11/ipsasb-issues-ipsas-49-retirement-benefit-plans

⁸ “IPSASB Issues Updated Chapters of Conceptual Framework”, 11 October 2023;

https://www.ipsasb.org/news-events/2023-10/ipsasb-issues-updated-chapters-conceptual-framework

⁹ “IPSASB Completed Projects”, https://www.ipsasb.org/ipsasb/consultations-projects/ipsasb-completed-projects